LOBs with pre-existing lender relationships had a higher chance of receiving a PPP loan

LOBs with a pre-existing lender relationship were 6.6x more likely to get PPP funding, primarily driven by technical assistance and constant communication offered by lenders.

16.5%

16.5% of LOBs with a pre-existing relationship with a lender (“Borrowers”) received PPP funding

2.5%

2.5% of Non-Borrowers surveyed received PPP funding

LOBs operational cash is Dwindling

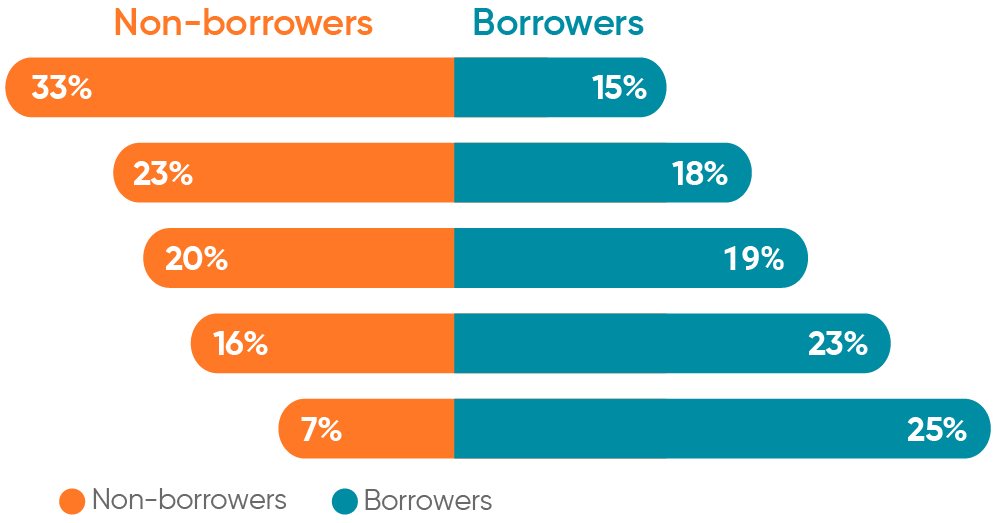

LOBs without an active relationship with a lender are less likely to have enough cash on hand to operate the business beyond 3 weeks.

ESTIMATED CASH ON HAND

Less than 3 weeks

3 weeks to 2 months

2 months to 4 months

4 months to 6 months

Over 6 months

LOBs are resilient in the ‘New Normal’

LOBs show greater signs of survival despite lack of access to PPP and other relief funds.

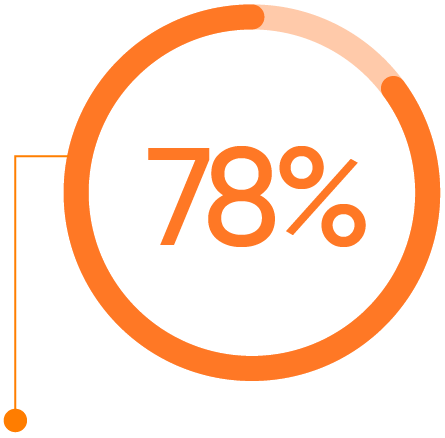

78% of LOBs have re-opened or resumed business operations as of August 2020 compared to 67% in June 2020

70% of LOBs believe their business will be as good or better than pre-pandemic levels

Despite resiliency from LOBs, most of their sales have not recovered to pre-COVID levels

Sales for the typical LOB are not expected to recover to pre-COVID levels until 2021. Further capital injections are required to bolster the rebirth of these businesses.

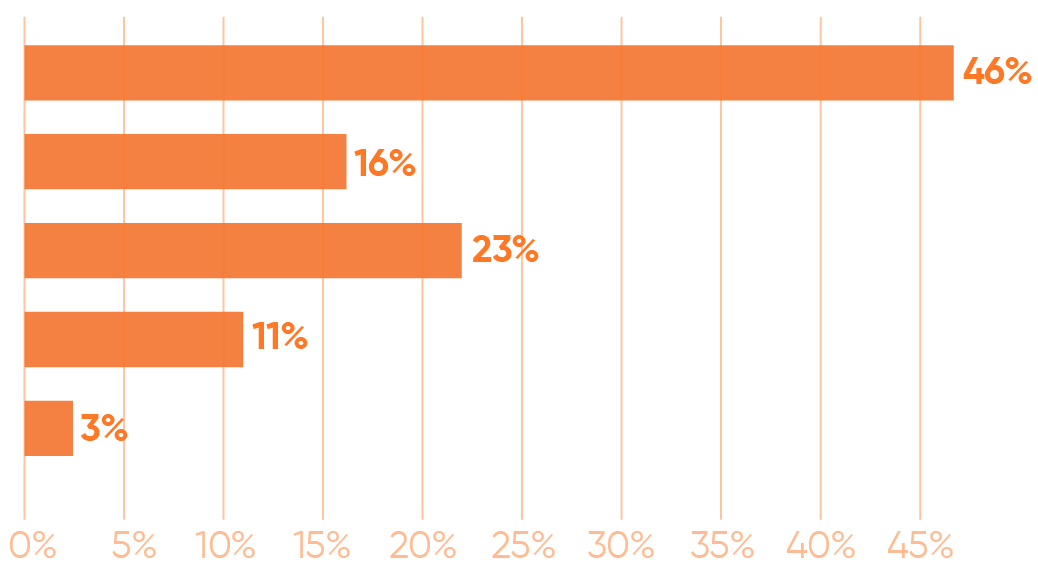

ESTIMATED % OF SALES IMPACTED IN COMPARISON TO THIS TIME LAST YEAR (JULY-AUGUST 2020)

Declined 30% or more

Declined less than 30%

Flat

Grew less than 30%

Grew 30% or more