Credit Crisis of Latinos

Capital critically needed for survival and recovery

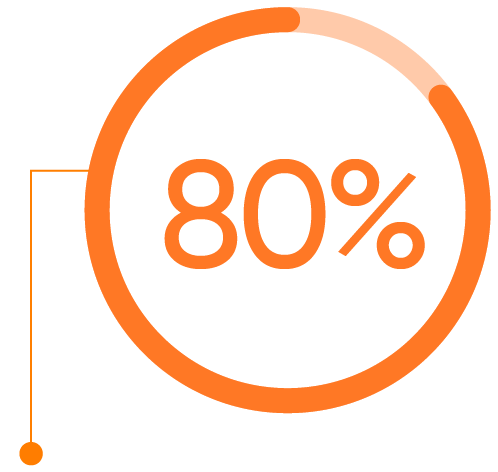

80% experienced a decline in sales

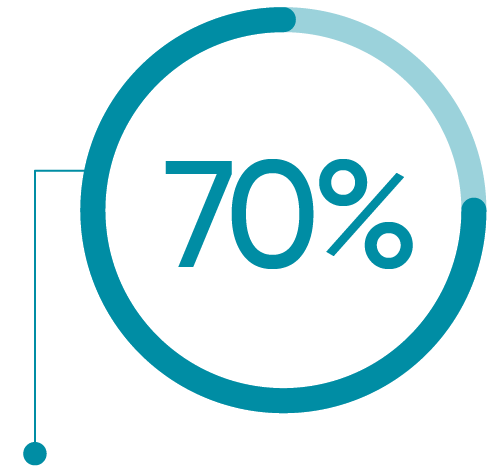

70% had to close at some point during the first half of the year

Credit Crunch: Capital even more difficult for Latino SMBs to obtain

LOBs experience significant obstacles in applying for government business relief

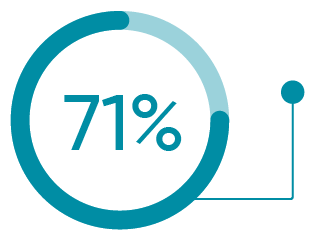

71% of Latinos did not apply for government business relief

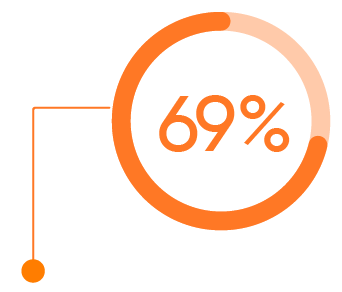

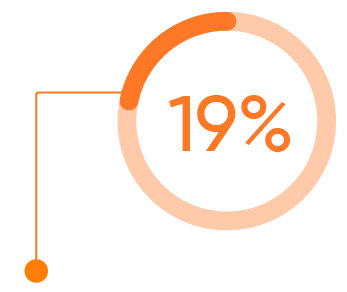

OF THOSE THAT DID NOT APPLY:

69% did not apply, required technical assistance or believed they would not qualify

19% required technical or other assistance in completing the application process

Latino-owned businesses discouraged from applying for Credit

Credit bias towards risk borrowers, foreshadowing a credit crunch with smaller and earlier stage business

37%

Latino applicants revenue increased by 37% in Q2 2020 vs PQ

32.6%

Business with less than 2 years of operation saw a revenue decrease of 32.6% in Q2 2020 vs PQ

Resilience during unprecedented times

The road to recovery is long but microenterprises are adjusting

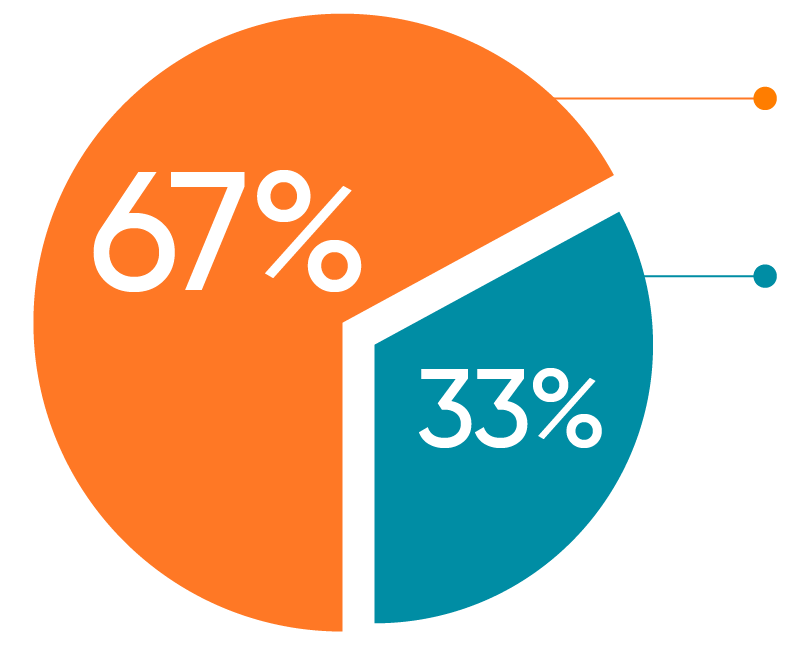

67% of LOBs are open for business

The remaining 33% are expected to re-open