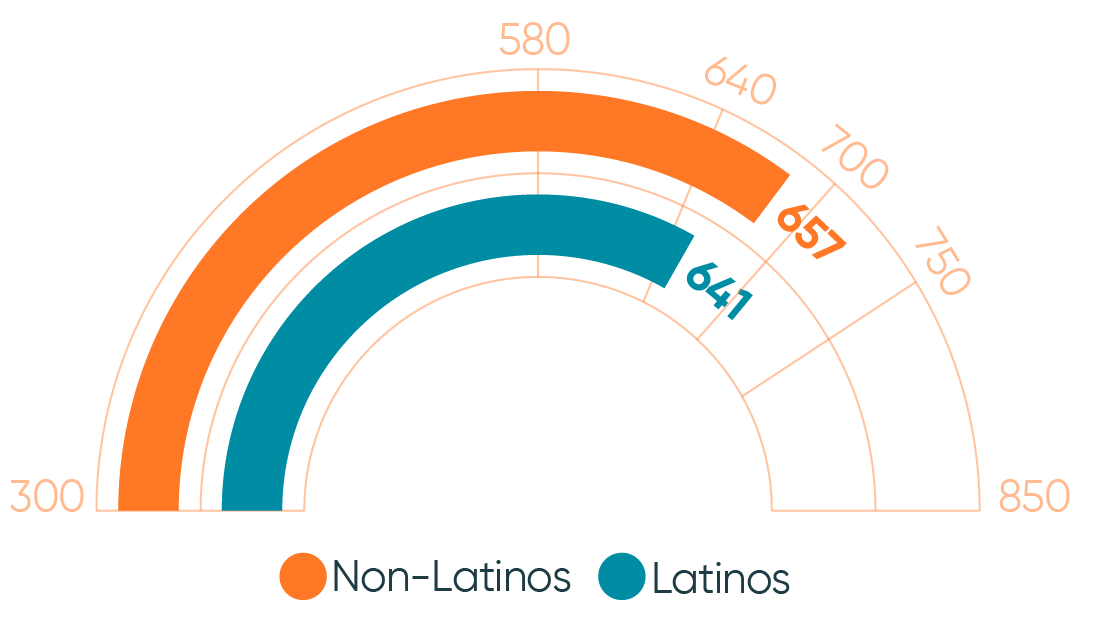

Credit scores for Latino applicants remain stagnant compared to their non-Latino counterparts

Non-Latino credit scores are at historical highs with an average credit score of 657, indicating that the average balance sheet of non-LOBs is stronger, potentially attributed to more access to COVID-related stimulus funds.

In comparison, Latino applicants’ credit score remained stagnant in Q2 ’21 with an average credit score of 641.

AVERAGE CREDIT SCORE NON LATINOS VS LATINOS