LOBs were disproportionately impacted by COVID-19 in 2020

Lenders drastically slowed non-government relief loans in the second and third quarters of 2020, instead focusing their efforts on PPP and other forms of government relief. A special COVID-19 Latino Impact Survey conducted after the first round of PPP in August showed:

PROFOUND IMPACT:

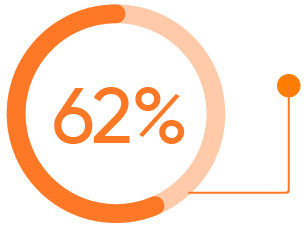

62% of LOBs generated less revenue than before COVID

NECESSITY OF EDUCATION:

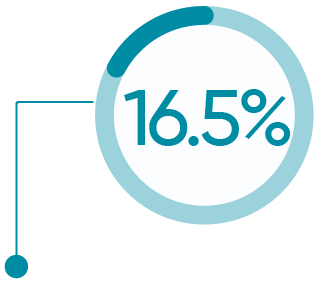

Most LOBs were discouraged from seeking additional funding or relief, with only 46% even applying

However LOBs were 6.6x more likely to obtain relief funds when provided education and support